Different financial products can also be drastically dictate your own month-to-month costs and the total price over the lifetime of that loan. Fixed-price mortgages protected your own rate of interest, guaranteeing consistent money throughout the identity.

On top of that, adjustable-speed mortgage loans (ARMs) you will start with lower repayments but could change, possibly boosting your financial weight down the road.

Going for between these types of alternatives relies on the risk endurance and you may economic balance. A fixed-speed you’ll match those trying predictable payments, if you’re a supply you may work with borrowers pregnant earnings progress or think to move ahead of cost to switch.

A lot more will cost you to look at

Just after choosing the right mortgage style of for your ?200k loan, its imperative to look at the extra costs that are included with to get a house. Such most costs is significantly apply to your financial allowance and full cost of homeownership.

- Stamp Obligations: This is exactly a taxation you only pay when selecting property inside great britain. The amount hinges on the latest property’s rate and you can be it your own first household.

- Solicitor Fees: You will need a beneficial solicitor otherwise conveyancer to deal with the fresh judge regions of to acquire a property. Its fees will vary according to the properties offered.

- Survey Costs: Just before finalizing your purchase, delivering a property questionnaire to test when it comes down to troubles pays. Surveys assortment in detail and you may price.

- Valuation Fees: Mortgage lenders wanted a property valuation to be sure it’s worth the amount borrowed. Possibly that it fee is included on the financial contract; other days, you need to pay they upfront.

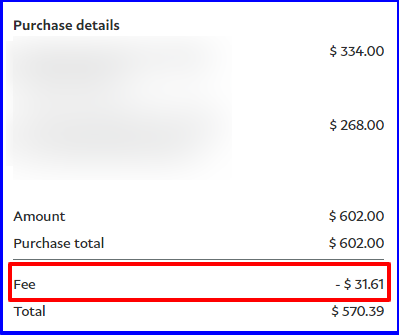

- Home loan Plan Charges: Certain loan providers fees costs getting creating the home loan. These could become large and they are sometimes put into the loan, which means that you can easily pay competitive interest rates in it too.

- Building Insurance rates: Lenders require that you features building insurance policies throughout the time you replace agreements. The purchase price hinges on the home dimensions and its venue.

- Moving Can cost you: Employing moving services or renting a good van increases the debts out-of moving into your new family.

- Furniture and you will Decorations: If you find yourself moving into a bigger room or doing new, consider the price of the brand new chairs and you can artwork your brand new set.

- Utility bills: Establishing utilities in your brand new home you are going to have initial configurations charges on top of typical monthly premiums.

- Repairs and you may Solutions: Owning a home function you may be guilty of all of the maintenance and you will repairs, which can are very different extensively in expense depending on exactly what need repairing.

Contemplating such even more can cost you ahead will help make certain you to taking out good ?200k home loan would not reduce your cost too narrow or hook you from the treat which have unanticipated expenses.

End

Knowing the month-to-month repayments into the a ?200k financial in the united kingdom relies on several important aspects you to the pace apply to payments and ought to be taken under consideration. Each borrower’s disease have a tendency to influence the month-to-month installment count, and also make products such as financial calculators extremely of good use.

Understanding how much you need to secure and you may conserve to own a deposit molds their borrowing from the bank power. The eligibility hinges not only with the income but also into the borrowing history in cash loan Clifton addition to sort of home loan you choose.

step 1. Simply how much salary must i score a 200k financial in the uk?

You want a paycheck which enables their mortgage repayments never to exceed a certain portion of your earnings, generally speaking making certain that what you buy the borrowed funds is actually in balance centered on British requirements.

2. What is the smallest put I will alllow for a good 200k mortgage?

The smallest put you need depends on lenders’ criteria however, aim to store if you can to attenuate their month-to-month payments and you may rates.