get a cash advance now

Why is it wise to prepay your home Loan?

Mortgage brokers have really made it possible for most people in order to realise its imagine home ownership. If you are prolonged period financing try desirable to of many because EMIs was under control, many as well as be cautious about an easy way to eliminate or repay its liabilities. Mortgage prepayment is one such as for example means that will help make that happen and certainly will meet the requirements a good clear idea throughout the long term.

It helps it will save you with the appeal prices

Mortgage brokers are significant costs that have a huge piece since the attention. After you prepay your finance up until the conclusion of tenure, you save drastically.

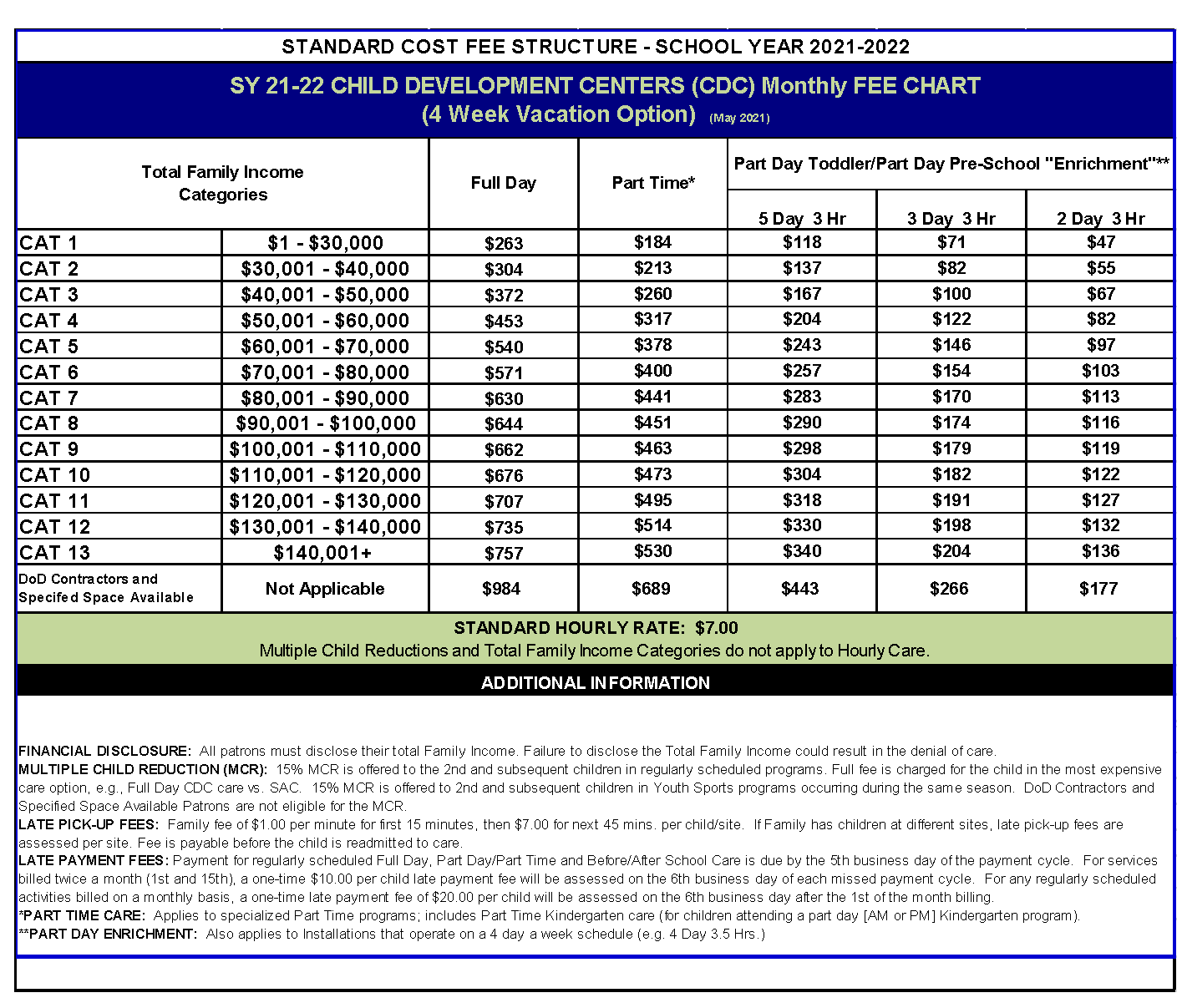

Think of this amortisation agenda for a mortgage from ?10 lakh at mortgage loan from 8% p.a. getting a tenure from 8 decades.

Regarding the above example, the entire desire matter on the loan period of 8 ages is actually ?step three.57 lakh. For folks who prepay the loan early in the period, you can save a lot with the desire pricing. Also, the eye cost spared can be used to complete other lifetime needs such as money to suit your child’s knowledge, retirement think, etcetera.

Change your credit score

Paying down the money up until the avoid of your own period manage imply their borrowing from the bank incorporate proportion drops. All the way down borrowing from the bank utilisation keeps a confident affect your credit report, as well as your overall credit history enhances. We all know one credit scores count generally in your ability to repay your own funds. When you are prompt money are good for maintaining a powerful credit rating, prepayment is an excellent cure for make as well as take care of a good credit score.

Alter your probability of choosing almost every other funds easily

As mentioned earlier, prepayment in your home Mortgage helps alter your credit score. With a far greater credit score, your chances of choosing from most other finance, eg car finance, team loan, education money, an such like., grows.

End fees non-payments

For those who pay off the part of the mortgage early, it can help you save out-of cost defaults developing in case out of disaster otherwise hard facts. Your absolutely do not know what the future keeps to you personally, however it does seem sensible to settle brand new percentage of your house Mortgage as fast as possible (when you have money) to eliminate people economic hiccups later on.

What you should keep in mind prior to prepaying your house Financing

Given that i have analyzed the benefits of prepaying Mortgage brokers, check out items you need thought before taking which action.

- Evaluate your http://cashadvanceamerica.net/payday-loans-ar/ current and you will future monetary means.

- Attempt to provides a sufficient crisis loans meet up with any unexpected costs.

- Find out if there’s any prepayment lock-into the period.

- Look for people prepayment punishment. Typically, Home loans which can be taken up fixed interest levels charges a prepayment punishment.

- For many who pay your home Mortgage very early, you might not obtain the income tax deduction. View the way it can impact your overall taxation just before performing this.

Completion

Prepayment away from Lenders best suits people who have free or extra funds. Using this type of, you might lower your borrowing load, change your credit rating and create fund getting essential monetary desires. At the Axis Lender, we realize the issues regarding controlling a mortgage, and we also is actually right here so you can each step of means. Our house Financing have versatile EMI possibilities, aggressive rates of interest, and you may a selection of other features which can help your house be to purchase feel problem-100 % free.

Disclaimer: This post is to own advice purpose merely. The new viewpoints indicated in this post was personal plus don’t always constitute brand new views away from Axis Financial Ltd. as well as teams. Axis Financial Ltd. and/or perhaps the journalist shall never be responsible for any head / secondary losses or accountability obtain because of the viewer when planning on taking any financial decisions according to the information and you can recommendations. Please speak to your economic coach prior to one financial decision