New FHA wishing several months once personal bankruptcy and you can foreclosure starts on recorded time or even the go out of the sheriff’s foreclosure deals and deed-in-lieu of property foreclosure. Also, there can be a good around three-season prepared period on quick sale time and you will in the go out of a home loan charge-off otherwise second mortgage costs-out to qualify for FHA home loans. Lenders as well as worry the significance of to avoid later repayments after a property foreclosure, deed-in-lieu regarding property foreclosure, or small marketing.

Its a familiar misconception you to a prior case of bankruptcy, foreclosures, deed-in-lieu out-of foreclosure, otherwise short sale will cause highest mortgage rates, instance off FHA fund. Alex Carlucci, an elderly financing administrator and party leader from the Gustan Cho Couples, clarifies this new perception ones events on the financial pricing, especially bringing up the newest FHA waiting period after bankruptcy and you may foreclosures:

Contrary to trust, a case of bankruptcy otherwise foreclosures does not change the cost regarding financial cost for the FHA funds, neither are there loan-level costs adjustments predicated on these types of occurrences having FHA money.

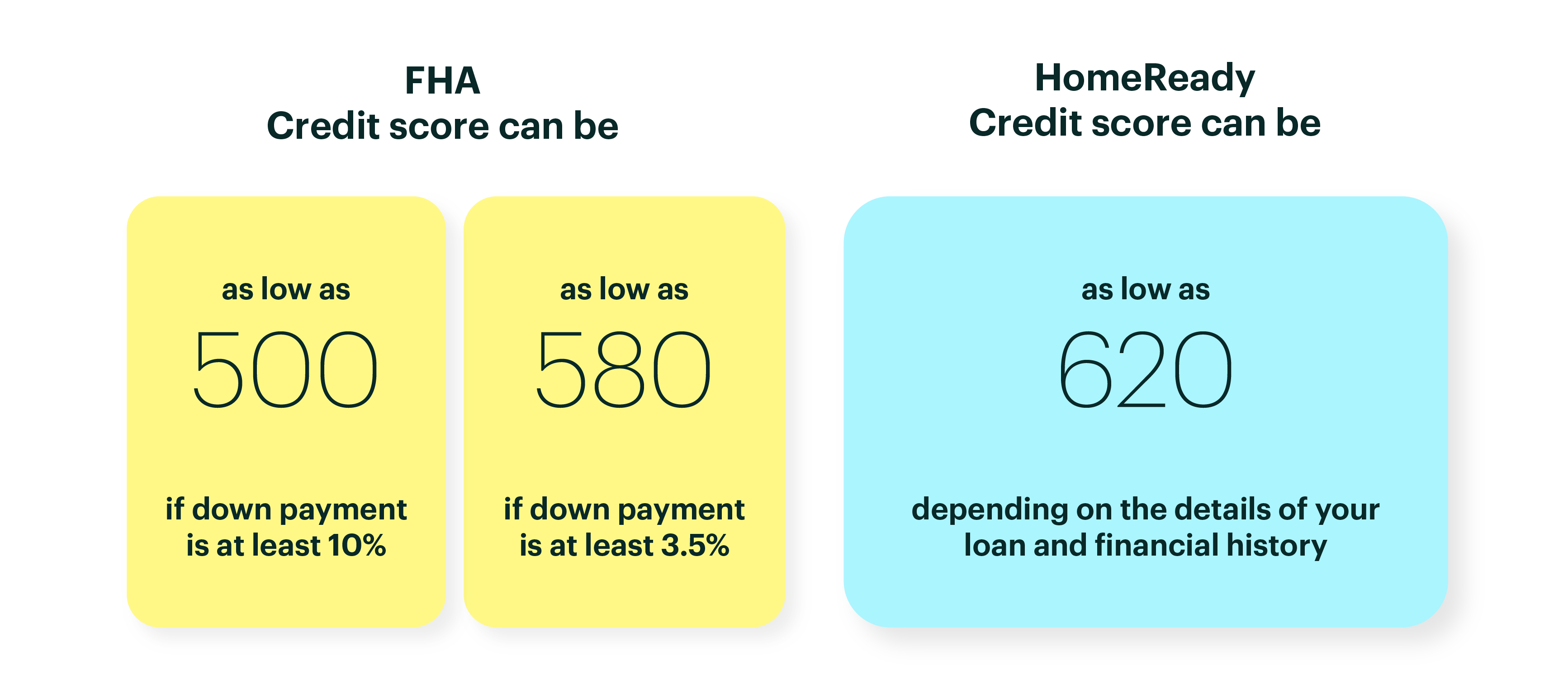

Fico scores would elitecashadvance.com bad credit personal loans guaranteed approval 10000 be the top determinant away from home loan costs having FHA money. In contrast, antique money consider fico scores and you can loan-to-really worth rates for rate commitment. Previous case of bankruptcy or foreclosures doesn’t change the interest rates individuals located into the FHA prepared several months shortly after bankruptcy and you may foreclosure. There aren’t any rates customizations of these events to the FHA home loan costs.

What are the Great things about an enthusiastic FHA Mortgage?

Because the an illustration, immediately following a chapter seven personal bankruptcy release, you can qualify for an enthusiastic FHA loan within 2 yrs, and you can shortly after a property foreclosure, you might be eligible from inside the three years. A great deal more versatile underwriting direction: The fresh FHA features way more easy underwriting criteria than just conventional lenders and could possibly get imagine compensating products like your a position record, deals, supplies, otherwise fee history when researching your loan app.

Exactly what are the Downsides out-of an FHA Financing?

An enthusiastic FHA financing also has particular disadvantages you should know in advance of implementing. Some of these cons is High mortgage insurance premiums: You will have to shell out one another an initial and a yearly mortgage insurance premium having a keen FHA financing, that can enhance their monthly obligations and you may settlement costs.

You’ll have to spend the money for annual MIP into the existence of one’s loan or at least eleven ages, based on their downpayment and you can financing title, whereas you can cancel the private home loan insurance rates (PMI) to have a normal loan after you achieved 20% guarantee of your house.

FHA funds has actually down loan limitations than old-fashioned money. The total amount you can acquire that have a keen FHA mortgage is subject to help you restrictions set by FHA, which will vary according to the state and type away from assets. This is why, in certain portion, you may find it hard to get a very pricey domestic playing with an FHA mortgage.

HUD Assets Standards For FHA Funds

Possessions standing requirements on the FHA financing is the assets should end up being safer, habitable, and safe. HUD features rigorous criteria on status and you may quality of the new property we want to buy which have a keen FHA financing. The property must meet with the minimal possessions criteria (MPRs) and citation an assessment from the an FHA-accepted appraiser.

The MPRs safeguards various regions of the property, like coverage, coverage, soundness, and you can hygiene. If the possessions doesn’t meet the MPRs, you may need to ask the seller and work out repairs otherwise use a 203(k) financing to invest in brand new repairs.

Old-fashioned Versus FHA Waiting Period Once Case of bankruptcy and you can Property foreclosure

An FHA financing enables you to be eligible for a mortgage sooner sufficient reason for quicker strict standards than simply a normal loan. Here are a few samples of exactly how a keen FHA loan can help you order a home just after different borrowing from the bank situations. An enthusiastic FHA loan has numerous advantages of consumers having a cards skills or any other demands in being qualified to possess a normal financing.