There are many things where old-fashioned lenders doesn’t approve your having a mortgage. And here a personal lending company will save you a single day. You might you need a personal mortgage lender regarding the pursuing the items.

- Your credit report isnt a good thus old-fashioned loan providers does not financing you. Having a credit score from below 600 you are not going to be eligible for a conventional mortgage.

- Financial institutions would not money the house or property you want to shop for since it is maybe not a normal possessions.

- You don’t need time for you hold off through the enough time approval techniques of your prime lenders.

- Youre thinking-operating or incapable of confirm your existing money, and so the finest loan providers won’t accept the loan you want.

- You would like that loan to own a brief period of energy.

It, hence, interest higher interest levels. Already rates on private mortgages range between ten% to help you 18% with regards to the economic situation of borrower in addition to properties of the property.

Interest levels along with count on which type of bank make use of additionally the rates out of come back your people need.

As possible pay high interest levels to own an exclusive home loan, you would merely go so it route if you cannot get financing approval away from a normal lender otherwise less than perfect credit financial.

What Fees Can i Purchase Personal Mortgage?

Once you acquire away from a conventional bank that you don’t worry about the charges since bank pays the latest fee. Having a personal lender, however, the fresh new debtor pays this new costs. There is also a create fee towards the private loan. Complete the newest fees arrive at whenever step one% to 3% of your borrowed count. The good news is, you can the brand new charge about financial.

The length of time Will it Attempt Score Recognition?

It will take significantly less time to score acceptance out of a private mortgage than just a normal financing. Approval will need ranging from two and seven days. You’ll receive the money within just 2 to 3 months. The private financial is within the business out-of brief-term loans. Might prepare that switch to antique lender in order that you can pay-off the administrative centre towards private financial in the avoid of your own label.

What Products Carry out Private Loan providers View?

- Money While unable to establish your income, individual loan providers will use a price of income predicated on a market average.

- Value of the lending company will require an appraisal due to the fact property obtains the borrowed funds. In case there is you defaulting its used to pay-off the main city.

- Down-payment you may need a deposit of at least 15% as the financing so you can worth proportion of the property must be at the least 85%.

- Guarantee having refinancing you are invited a max financing to property value 85% when you find yourself refinancing.

Guidelines on how to get approved for a personal mortgage

Bringing an exclusive mortgage isn’t that difficult however it does help prepare yourself before applying. Proceed with the following suggestions and you will probably have a much best opportunity out-of making certain that your qualify.

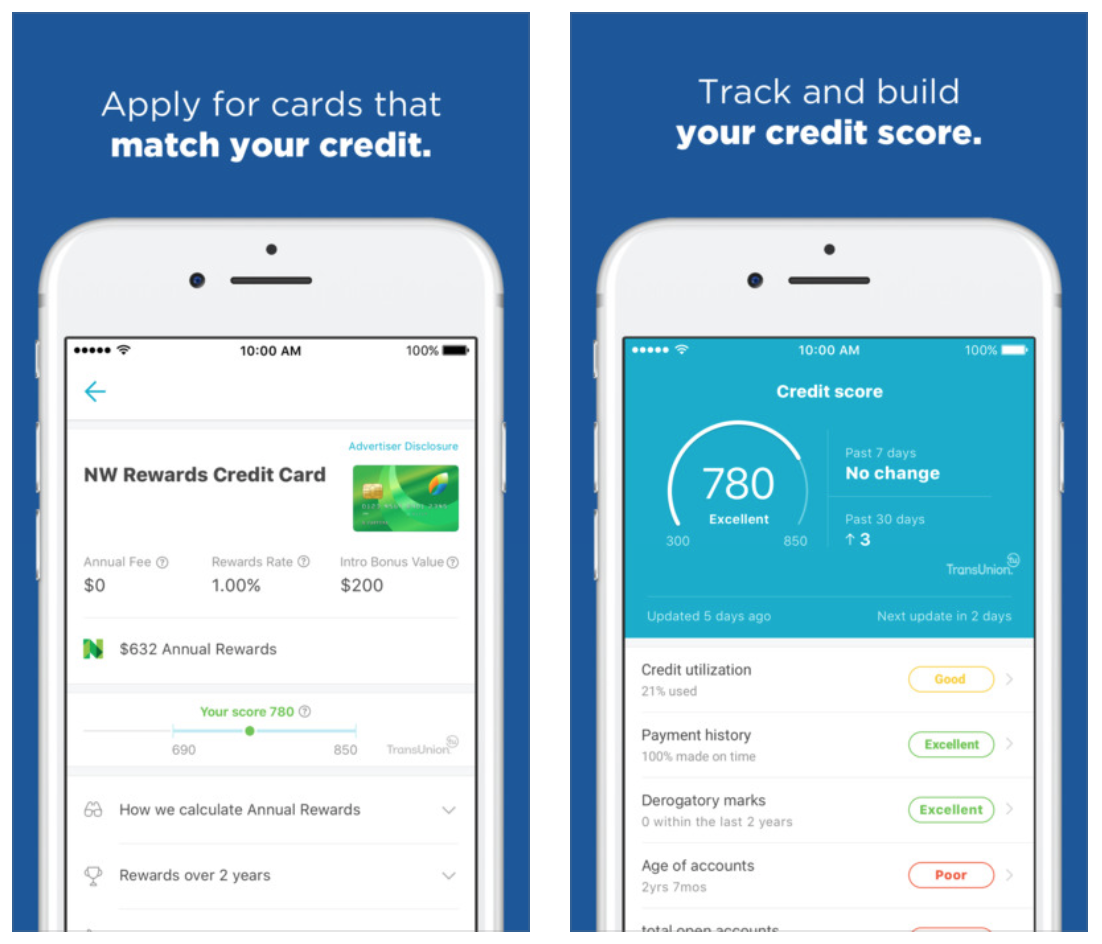

Understand your credit score

Even in the event private lenders was smaller worried about your credit score than the property value the house or property that protects they superb website to read, the financial institution usually look at the get. Its tried it to decide just how a big a threat youre. The greater your credit score the newest reduced attract might shell out on the home loan. Its, thus, important to see your while the a comparatively short upsurge in focus prices can add up along the financial term.