Shopping for a home that feels as though residence is never effortless. If open domiciles are arriving up short, or perhaps, if you have discovered the perfect parcel, you’re considering building your future assets. Whether your dream home has mainly based-when you look at the stores for optimum company, a great chef’s home and come up with their grandmother’s greatest lasagna meal, and/or best staircase to own friends photographs, a housing mortgage will help build you to definitely dream possible.

Framework funds can be complicated, so let’s break down this one and you can what the household-strengthening process you are going to look like to you.

You’re certain used to mortgage loans, which happen to be always get current properties. However in purchase to invest in the expense of strengthening another family, you may need a property mortgage . Lucky for you, Virginia Credit Connection even offers these types of loans to be able to financing building your ideal house or apartment with VACU always.

Structure Mortgage Basics

A housing financing was a great fit for your requirements in the event that you’re not to order from inside the an alternate subdivision, where builder most likely has a construction line of credit. Outside subdivision advancement, designers is actually less likely to has actually their particular financing choice, so a property loan thanks to Virginia Borrowing from the bank Commitment can present you with the fresh independence to pick the best place for you and your nearest and dearest.

Already know in which you need certainly to make? You could add the purchase of house or package during the your design financing. Or, if you’ve already purchased it, you should use your framework financing to settle a current lien towards the property otherwise lot.

Being qualified to have a homes Loan

Because there is absolutely no collateral (but really!), the latest club to help you be eligible for a construction financing exceeds their regular financial. It should be your primary house and you will need a card get of at least 740. (Not quite indeed there yet? Find out more about your credit score and the ways to increase it. )

Having Virginia Borrowing Relationship, your design financing have to be for at least $fifty,000 having a loan-to-value of 80 per cent. That implies you truly need to have 20% collateral throughout the assets, which navigate to website can make kind of a down payment or even the worth of the lot for individuals who already very own this new home. Additionally, you will be able to pick an expression of half a dozen, 9, or one year until your dream house is situated and in a position to help you undertake!

It’s not surprising that this is one of well-known concern i get out-of potential new house owners. Most of the condition varies, and now we are content to walk your because of what works to possess your dream as well as your budget. But you to definitely important thing knowing earliest is that on the construction processes, you may be only paying rates of interest towards the currency that has been paid back toward creator.

Such as for instance, whether your builder’s draws a total of $a hundred,100000 within the third few days regarding structure into the a beneficial $three hundred,000 mortgage, possible only pay attention for the $one hundred,000 you to definitely few days. Once the developers mark more cash to do your home, your monthly installments increases throughout the newest generate, leading to an excellent sensible cure for generate property.

However dreaming from higher ceilings in addition to best consider? Here is how to get going.

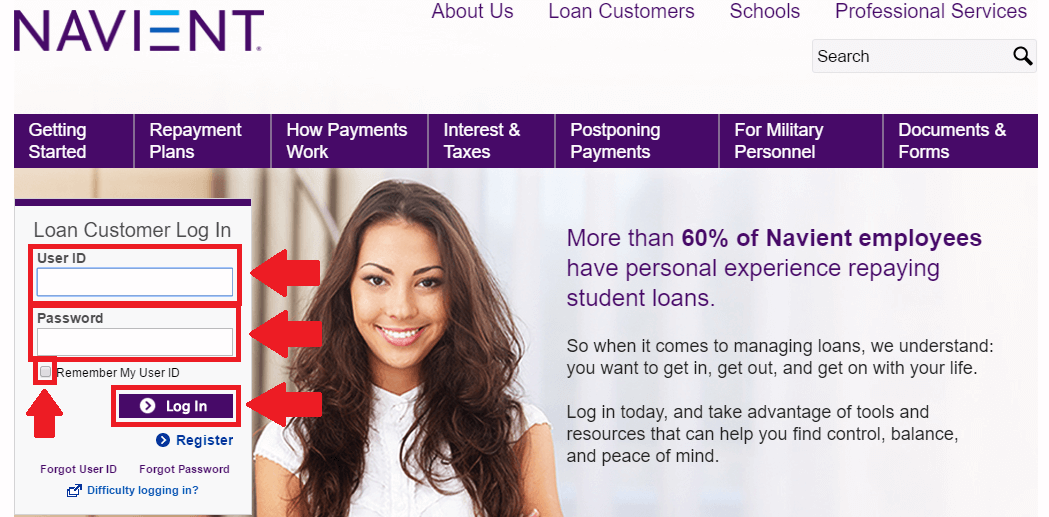

- Make an application for a property LoanPrepare the mortgage app documents, after which help all of our pro class take you step-by-step through the brand new pre-certification and you will software techniques for their structure mortgage.

- Place your Dream into the PaperSecure a creator and you will establish the new arrangements for this primary home (we are able to practically smelling Grandma’s lasagna currently!). The agreements, specs, and you can creator will all the should be closed and analyzed by the VACU so you’re able to romantic in your financing. During this time period, we will aid you which will make good draw plan, that’s a timetable having repayments from the mortgage for the creator since the structure moves on.

- Personal on your own Structure LoanOnce approved, their structure mortgage usually relocate to closing. Ready your greatest signature for everyone of your paperwork along with your finance for settlement costs and one called for down-payment as well.

- Break Soil on your own 2nd AdventureAfter closing, design may start. Virginia Borrowing Union features married which have a digital system titled Centered to plus creator effortlessly manage the fresh new pulls online for each and every stage of your own structure so the builder is be distributed directly from the loan immediately.

- SayHello in order to Domestic (and a permanent Mortgage)After structure is done, their build financing has to be refinanced to the a basic long-label home loan or otherwise paid back. So as men and women last information work together in your fantasy home, their real estate loan administrator will work with you to help you re-finance your own construction mortgage in order to a long-term home loan.

Have questions relating to construction fund? That is ok! We have been right here simply to walk your from processes and what is actually finest to you personally.