cuatro. You will not need Prime Credit

You will not need primary borrowing so you can be eligible for a cellular domestic title mortgage. For the reason that the financial institution use your property since guarantee into the mortgage, and generally are, ergo, alot more willing to manage people who have shorter-than-primary borrowing.

5. You can aquire the cash Rapidly

An additional benefit out-of a mobile family label loan is that you could get the money easily. For the reason that the whole process of delivering a vintage mortgage can be end up being extremely sluggish and you will complicated.

Which have a mobile family term mortgage, the procedure is much easier, and you may commonly get the money within this months otherwise months.

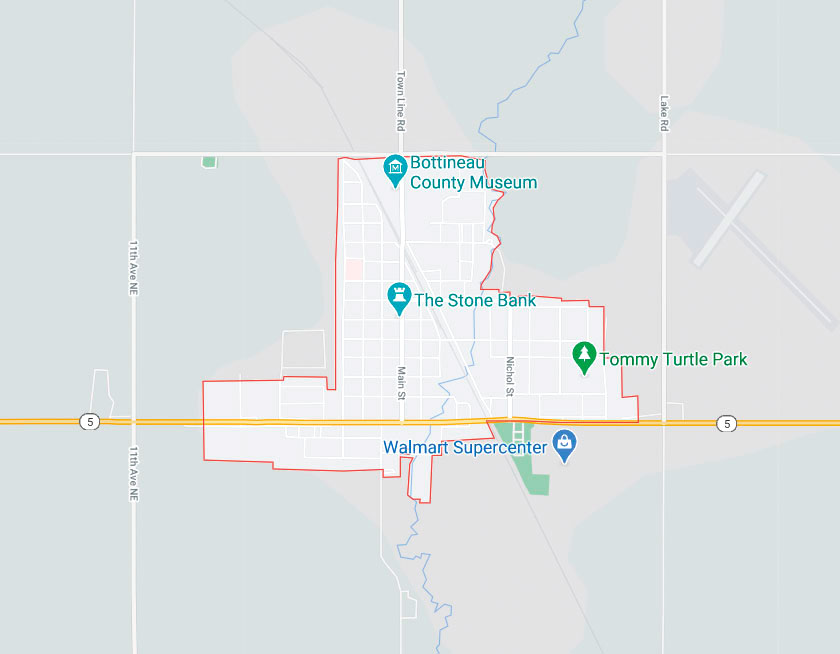

A number of key differences between mobile and you can are built belongings will be listed prior to getting both types of financing. With a cellular family label loan, you could instantaneously supply your home whether it’s situated on homes belonging to you or not.

You don’t need to a similar amount of credit score as with a created household term mortgage; specific lenders actually render fund to people which cannot qualify for old-fashioned mortgage loans. The interest rate getting mobile mortgage brokers is normally lower than one to to own are made lenders also.

Cellular residential property will likely be went doing as required, while are made property you should never. It is because they are built to withstand long lasting location in one place.

Cellular homes typically have reduced insulation than just are formulated residential property, leading payday loans Millerville them to hotter/hot in the winter months and you can cooler in the summertime.

Cellular home structure constantly spends lower materials than just old-fashioned design, which could result in lower-high quality ends up otherwise architectural dilemmas over time.

Exactly what are the dangers regarding the cellular domestic label loans?

There are numerous threats regarding the cellular family term finance, however, total they truly are a very of use option for those people who require money. Here are about three quite prominent risks:

Financing might not be paid on time. Mobile home individuals are apt to have shorter collateral in their house than simply conventional home loan consumers, so there was a greater exposure that they will not become able to pay back the loan into best time.

Consumers might end upwards due more cash than what is lent. As opposed to traditional mortgage loans, in which lenders generally assume that pay off all of your financing count also attention and fees, that have cellular home title financing, certain individuals finish due more money since lender will not sell otherwise dispersed the house or property until it is completely paid off.

If the the unexpected happens suddenly and you may slow down the product sales process, the new borrower becomes unpaid on the mortgage and are obligated to pay also more income than just in the first place lent.

Defaulting to the a cellular household identity loan can result in foreclosure proceedings and you will you’ll be able to seizure of the home of the loan providers.

This might result in disastrous economic consequences for your (new debtor) Along with your loved ones who live when you look at the/around your trailer park residence.

How to deal with a mobile house name loan you can not spend straight back

Dont worry about it; there are a few selection open to you. You could re-finance the loan or take away a moment home loan in your no. 1 quarters.

Although not, such possibilities may wanted additional money off than currently available on the savings account. In this case, envision a property security line of the financing (HELOC).

An effective HELOC makes you borrow around 100% of one’s property value your home facing coming income and you may repayments. This provides your accessibility funds rapidly and without having to place people downpayment or shell out interest rates typically greater than the individuals for conventional money.

Whenever you are HELOCs commonly always your best option for everybody, they truly are an affordable solution to initiate repairing otherwise reconstructing your cellular household kingdom!