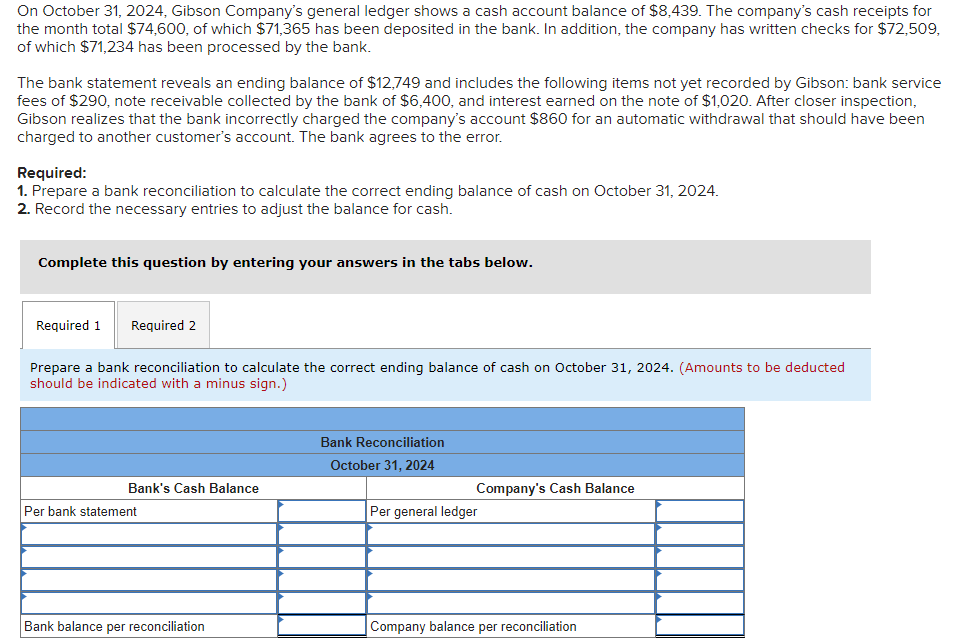

Your residence mortgage often typically be your biggest debt, while you reside your largest resource. The easiest way to remember to could keep using your loan away from and you will preserve control in your home is by using Home loan Cover Insurance coverage (MPI).

It is mortgage security insurance policies worthy of they, or perhaps is they an unimportant insurance coverage add-with the? Find out right here, and just how far it can cost you and you will exactly what it discusses.

What’s home loan safety insurance policies?

Financial safety insurance policy is a type of coverage where the debtor are safe in case they may be able no more pay the house loan due to specific situations like:

- Jobless

- Vital problems

- Burns off leading you to incapable of functions

- Passing

Mortgage defense insurance rates will help you to coverage your property financing payments in the event the these types of unplanned circumstances happen. Because of the within the financial for people who pass away, they assurances your beneficiaries will be able to retain the home.

Part-time otherwise relaxed group additionally the care about-operating, all working lower than 20 occasions weekly, tend to generally speaking be unable to score safety.

Some individuals can get mistake financial safeguards insurance policies and you can Lender’s Mortgage Insurance policies (LMI). The difference between the two is that mortgage safety insurance policies protects your in the event you standard on financing.

On top of that, your own lender is actually protected by lender’s home loan insurance in the event you standard on loan. Rather than insurance which can be always elective, LMI is commonly required and you can is applicable whenever a debtor are unable to spend in initial deposit of at least 20% of your own property’s rates.

So what does home loan safety insurance cover?

- A one-regarding swelling-share commission with the the harmony of the home financing. People leftover finance can be used by the family members to own any purpose.

- A payment per month to cover your payments on account of your https://cashadvancecompass.com/personal-loans-nj/ distress serious illness or injury. This type of repayments can vary from thirty days to 3 age.

- A payment to cover your instalments on account of losing a position – tend to not any longer than 90 days. Home loan defense insurance rates simply discusses jobless if you’ve been fired otherwise produced redundant – not when you have prevent your job.

You to very important indicate note try very principles exclude one pre-existing diseases. Like, if the a medical professional possess cited you due to the fact which have a condition or injury on one year before you purchase the insurance coverage, it’s unlikely you might be safeguarded.

- How big is the loan

- This new cost count

You could buy financial security insurance rates sometimes because a lump sum fee or if you could probably create your percentage monthly, depending on your own insurance company.

As a general rule regarding flash, home loan defense insurance rates rates as much as 0.5% to 1% of the amount borrowed to your an annual base. When you shop available for an enthusiastic insurance company, make sure to rating various quotes to be certain you might be getting the cheapest price.

Would you like mortgage security insurance coverage?

Home loan security insurance coverage only covers your for the home loan repayments would be to you sustain a meeting one to influences your earnings. It means, you still features almost every other debts to spend such as for example: cost of living (time debts, phone expense), car membership, university university fees charges, and you can restaurants expenditures.

Have there been selection to help you mortgage shelter insurance coverage?

If you were to think financial shelter insurance rates may not be suitable for your, check out additional options to consider, that can help with mortgage repayments.

Life insurance coverage

Also referred to as demise shelter, life insurance coverage will pay out a lump sum to whoever are selected in your plan once you perish. Since the people can use the money to possess whatever they would you like to, it may wade with the mortgage payments and any other expenses.

Earnings defense

Money defense covers your in the event you get rid of your earnings to disease otherwise burns off. It is made to safeguards your revenue by as much as 85%, which can be used as you wish (for the costs, not simply the borrowed funds). To track down protected, you need to pay a fee every month.

Full and long lasting disability (TPD) coverage

TPD gives you a lump sum payment to own long lasting loss of work because of serious disease or burns. Will put into insurance, you need to use new payment to fund the mortgage payments and you may almost every other necessary expenses.

Get in touch with one of the friendly credit specialist to get the techniques to your fantasy domestic for less otherwise cut thousands on the current mortgage.