advance bad cash credit loan

When a borrower defaults on their mortgage and you can manages to lose their house in order to foreclosure, the lenders get the property

Should you decide purchasing a different sort of house, you are probably want to a home loan making it happen. Most people cannot afford purchasing a property in the place of searching good loan.

Yet not, if you want a mortgage, you should be eligible for you to. Just what exactly manage loan providers examine after they know if you qualify or perhaps not?

Mortgage brokers and you can financial institutions now just want to provide currency so you’re able to the individuals customers most likely making the monthly home loan repayments to your time. Think of, financial institutions and you may lenders do not want to enter into our home-offering providers.

Credit history

Your about three-digit credit history happens to be an essential count. Lenders look at this score when they determine who to lend in order to at what rate of interest. This is why it is so crucial that you display screen your credit score daily, making certain you keep up they during the a genuine level.

When your credit history are reasonable – state, 640 or all the way down on common FICO credit-scoring system – you might not be eligible for a mortgage of antique loan providers. If you, you’ll certainly need to pay large interest rates.

That’s because borrowers having reduced credit scores provides a last away from destroyed auto loan, charge card or student loan money. They may likewise have a personal bankruptcy otherwise foreclosures within previous. As an alternative, possibly he’s stuck with a high personal credit card debt. Many of these missteps tend to down a credit score. Lenders was wary about credit money so you’re able to consumers with records out-of missed money.

If the credit score is superb, and therefore a score out-of 740 or even more towards the FICO size, you can considerably boost your ability to be eligible for an educated mortgage as well as the lower rate of interest.

Debt-to-income rates

Lenders will even look at your profit to choose for people who are a great borrowing from the bank risk. Especially, loan providers need certainly to determine how big the gross monthly money – your earnings just before taxes try applied for – than the both the financial or any other expenses.

The front-end proportion requires a peek at how much of the disgusting monthly earnings your month-to-month mortgage payment – together with dominating, taxation and you can insurance coverage – takes right up. As a whole, loan providers require their homeloan payment when planning on taking upwards only about 28 percent of your gross monthly earnings.

The trunk-avoid ratio considers all your valuable expenses, everything from their mortgage repayment loans in Thompsonville for the student loan and you may car financing repayments on the lowest amount of cash you are expected to send to help you creditors every month. Lenders prefer handling borrowers whoever overall monthly expenses take no more than 36 percent of its terrible month-to-month money.

The fresh new lender’s objective is always to make sure that your monthly costs aren’t very burdensome that they may overpower your economically when you include a month-to-month mortgage payment near the top of all of them.

A position

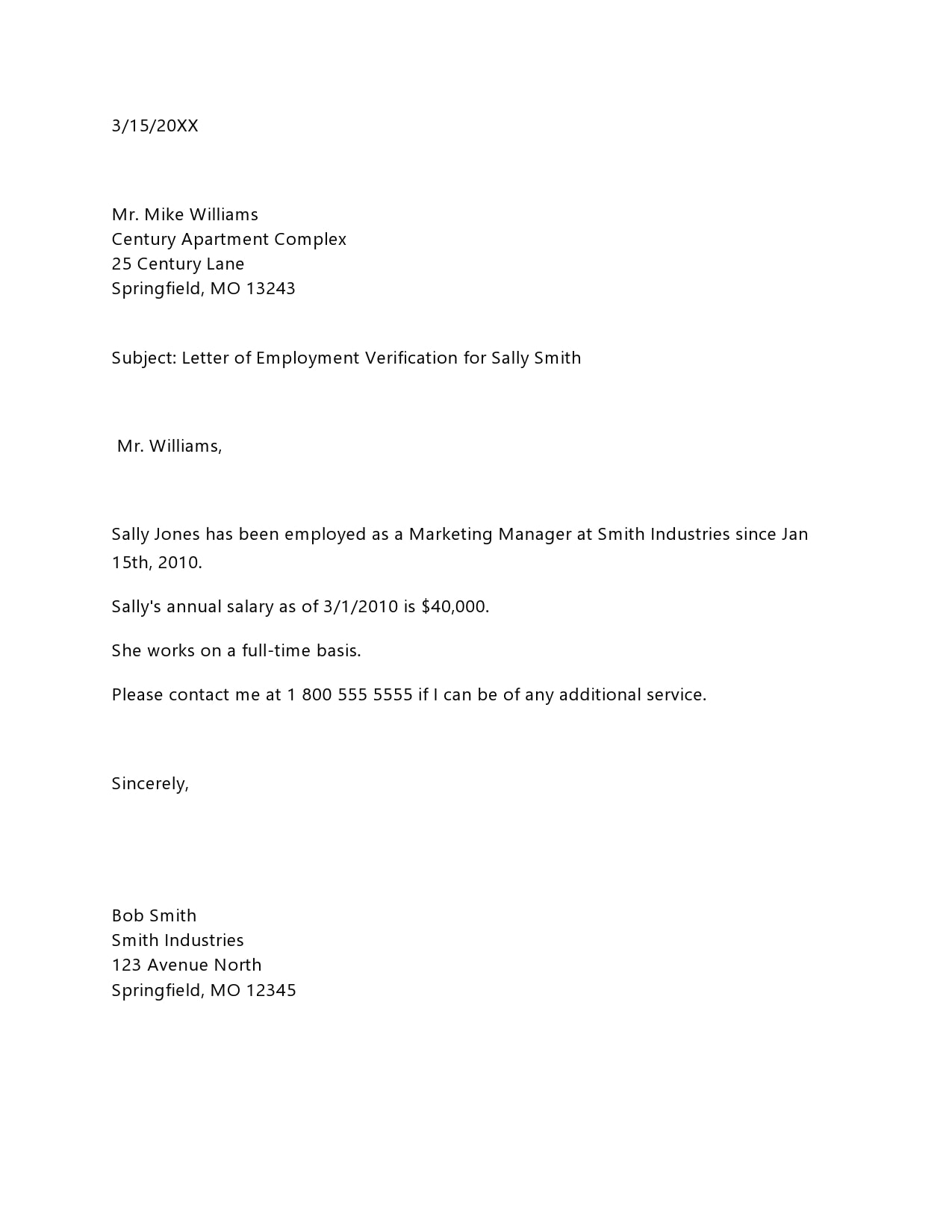

Loan providers will at your a career records, as well, ahead of lending your money to own home financing. Most loan providers always work on borrowers who’ve spent during the the very least the final couple of years in identical industry. He could be significantly more shopping for borrowers who possess worked with the same organization for those 2 years.

Lenders take a look at such as for example a-work history just like the a sign of balances, and like lending so you can borrowers exactly who it see just like the secure.

Yet not, what if youre notice-employed? You will have to functions a tiny much harder so you can encourage lenders that you have a steady blast of monthly money. You’ll likely need upload the lender duplicates of your past around three years’ worth of tax statements to demonstrate all of them that the yearly income, even when you have been self-working, has been constant.

Summary

If you don’t be eligible for a loan today, usually do not panic. You can always try to alter your earnings before trying again.

You will be able, by way of example, to boost your credit rating. You’ll be able to just have to perform a different sort of history of paying your expenses promptly. Additionally, you will need certainly to reduce your credit card debt. Improving your credit score usually takes months, otherwise offered, but if you make a great monetary behavior, you possibly can make it takes place.

It’s also possible to better the debt-to-earnings percentages by paying off your debts and seeking a means to enhance your disgusting month-to-month money. Perhaps you will find a better job or score a raise. Meanwhile, it is possible to make oneself look appealing to loan providers of the carrying off your work to have per year or two before applying again for your real estate loan.

Put another way, try not to call it quits. When you get refused for a mortgage loan, work to replace your funds. You might be a citizen.